In 2022, we saw a radical product presented to the world. Today’s ‘Rosetta Stone,’ ChatGPT, has dazed our ideology of artificial intelligence for the unforeseeable future. After many years of only existing in the realms of science fiction and visions of tech developers, the long-awaited anticipation around AI is approaching a period of mania.

Source: Click Here

Navigating Uncertainty: The Resilience of AI Investments

In 2022, we saw a radical product presented to the world. Today’s ‘Rosetta Stone,’ ChatGPT, has dazed our ideology of artificial intelligence for the unforeseeable future. After many years of only existing in the realms of science fiction and visions of tech developers, the long-awaited anticipation around AI is approaching a period of mania.

The excitement and anxiety around AI reinforce the notion that these models are foundational and a significant turning point in the field, a notion strengthened by the expectation that the global AI market will surpass the US$1 trillion mark by 2032

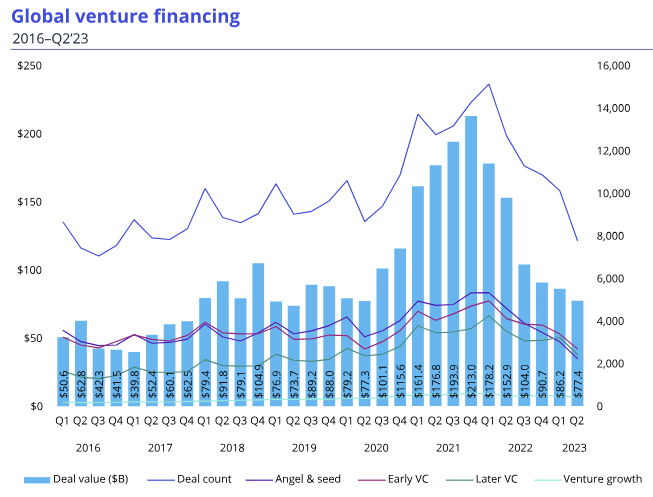

This still holds despite headwinds in today’s market conditions. Presently, with no end in sight to market challenges, VC investors globally continue to hold back from making large mega deals due to the continuous uncertainty; nevertheless, investments in AI continue to be red-hot.

Market Uncertainty

To begin with, observing the world’s macroeconomic outlook, uncertainty continued and will continue to permeate the global venture capital market in the second half, H2, of 2023 going into the first quarter, Q1, of 2024. This is due to continuous geopolitical uncertainties, dramatically high inflation, and the possibility of a further hike in interest rates. Contrarily, investment in AI and generative AI remained strong as startups globally looked to accentuate their AI capabilities. Venture capital investors enhanced their focus on the artificial intelligence space, seeing it as one of the few resilient areas in the current market.

Source: Click Here

According to the Organization for Economic Cooperation and Development, 21% of the share of global VC investment in 2020 (their most recent compilation) went into AI, an estimated US$75 billion. Further, investments in AI increased by another 20% in the last year of the study. Now, focusing on Q2’23, corporate investors showed the most interest in the generative AI space, particularly global tech giants with the massive data sets required to underpin robust generative AI solutions. Additionally, both Microsoft and Google have already made major inroads into the space, including Microsoft’s US$10 billion investment in OpenAI during Q1’23, along with China’s tech giants – Alibaba, Baidu, and Tencent. Moving into Q3’23, Baidu’s ChatGPT-style AI begins to earn as sales beat estimates. The company, which this year delivered China’s first major competition to OpenAI’s ChatGPT, illustrated a more substantial than expected 6% rise in revenue to US$4.8 billion from July to September. Baidu amassed 70 million users three months after its public rollout.

For those interested, below is a list of companies in the AI sector that became unicorns in 2023:

Large Language Models:

Video:

AI Platforms:

Conclusion

To conclude, global venture capital investments are not expected to change radically heading into H2’23, although this prediction is in no way a certain bet. Given the continued geopolitical challenges, the lack of confidence exits, ongoing uncertainty, and the possibility of future interest rate hikes, there remains the potential for VC investments to take another hit in H2’23. However, enthusiasm has been driving AI-related stocks and investments this year. AI-based investments will likely remain a hot area of venture capital investments globally, particularly among large corporations looking to avoid missing out on what many see as a major multi-industry game-changer. Even though VC investments are at a halt, AI has never been more promising than ever. It’s never too late to start!

"Short term, AI may be less of a hyper-growth investment area than people think because it has to get to the stage where it is being commercialized and people and businesses are willing to pay for it. In the long term, the potential for AI globally is dramatic. It could cut down on the repetitive work that people do and remove inefficiencies from all kinds of processes. The big question I have long term is, what will the cutting of a lot of junior staff do to the leadership pipeline of companies?" - Jonathan Lavender, Global Head KPMG Private Enterprise, KPMG International

Comments